Emerson vend sa participation restante dans Copeland à Blackstone

St. Louis & New York (August 13, 2024) – Emerson (NYSE: EMR) today announced that it has completed the sale of its remaining 40% equity stake in the Copeland joint venture to private equity funds managed by Blackstone Group.

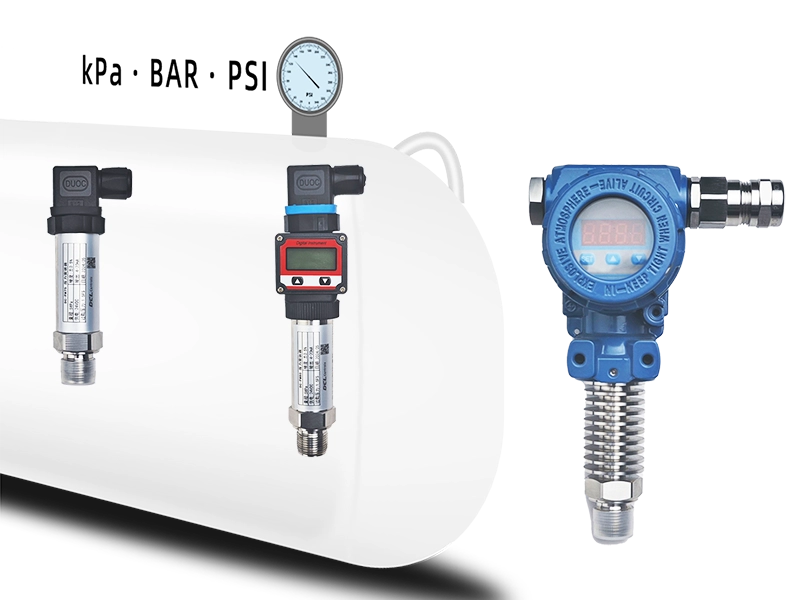

Copeland, an independent company focused on serving the global HVAC and refrigeration markets, offers a comprehensive product portfolio that includes market-leading compressors, controllers, thermostats, valves, software, and monitoring solutions for residential, commercial, and industrial customers.

À propos d'Emerson

Emerson (NYSE: EMR) is a global technology and software company providing innovative solutions to critical industries worldwide. Through its leading automation product portfolio, including a majority stake in AspenTech, Emerson helps process, hybrid, and discrete manufacturers optimize operations, protect people, reduce emissions, and achieve their sustainability goals. For more information, visit Emerson.com.

À propos du groupe Blackstone

Blackstone is the world’s largest alternative asset management firm. We aim to deliver significant returns to institutional and individual investors by enhancing the companies we invest in. Blackstone manages over $1 trillion in assets across global investment strategies, including real estate, private equity, infrastructure, life sciences, growth equity, credit, physical assets, secondary markets, and hedge funds. For more information, visit www.blackstone.com and follow us on LinkedIn, X (Twitter), and Instagram at @blackstone.

Forward-Looking and Cautionary Statements

This press release contains forward-looking statements that involve risks and uncertainties. Emerson undertakes no obligation to update any of these statements to reflect subsequent developments. These risks and uncertainties include the scope, duration, and eventual impact of the Russia-Ukraine conflict and other global conflicts, as well as economic and monetary conditions, market demand, pricing, intellectual property protection, cybersecurity, tariffs, competition, technological factors, inflation, and other risks as discussed in the company’s most recent 10-K report and subsequent filings with the U.S. Securities and Exchange Commission.

Emerson uses its investor relations website, www.Emerson.com/investors, to disclose information that may be of interest to investors or is material to their investment decisions. In addition to our press releases, SEC filings, public earnings calls, webcasts, and social media, investors should monitor our investor relations website. Information available on or through our website is not incorporated by reference in this document and does not form part of this document.

鄂公网安备 42018502006527号

鄂公网安备 42018502006527号